Download Reports

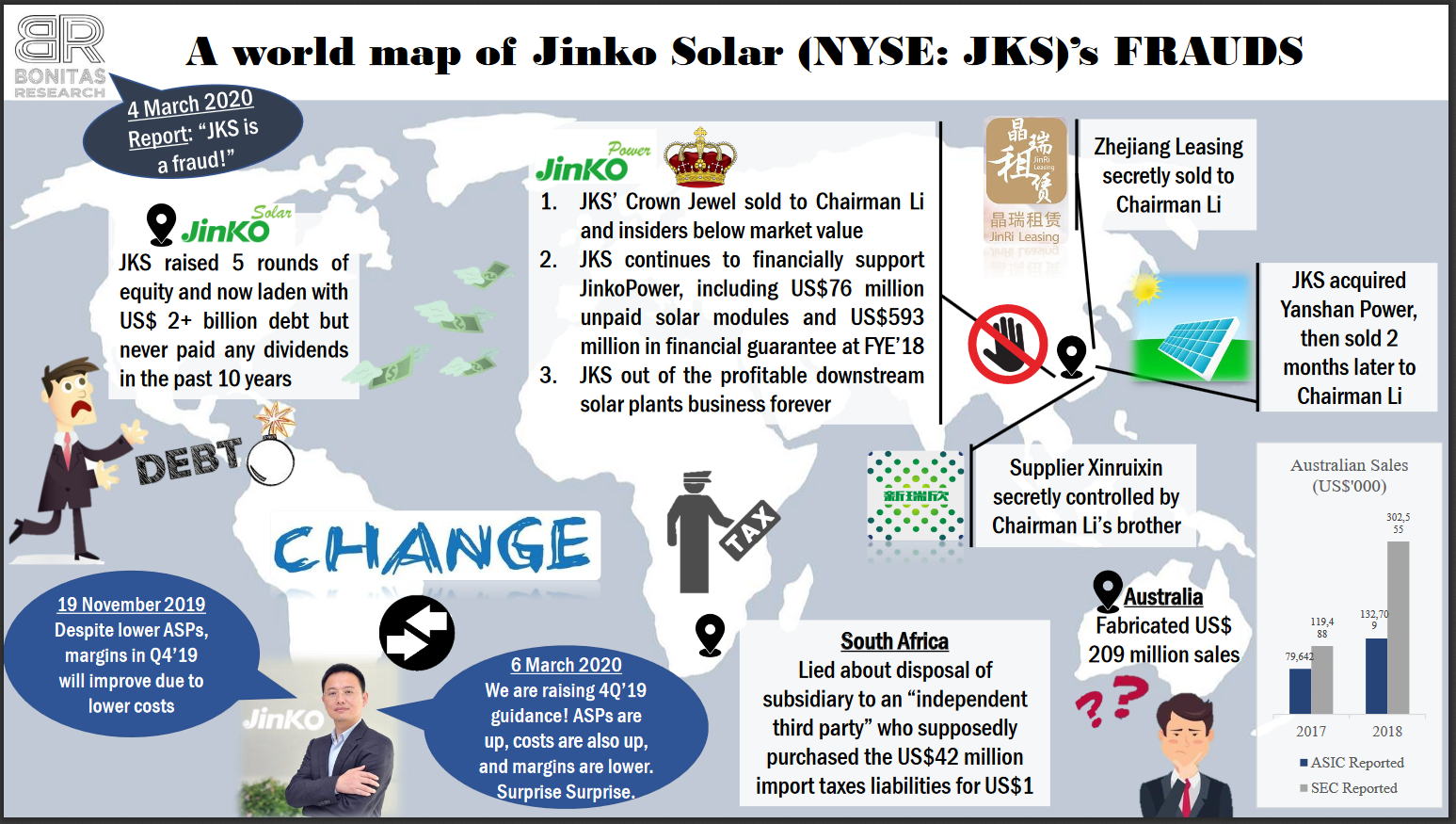

March 11, 2020 - 博力达斯研究_反驳_晶科能源(纽交所JKS) March 11, 2020 - Short JinkoSolar (NYSE: JKS) Infographic March 11, 2020 - Remain Short JinkoSolar (NYSE: JKS) Part 2 March 4, 2020 - 博力达斯研究_沽空_晶科能源(纽交所JKS) March 4, 2020 - Short JinkoSolar (NYSE: JKS)We believe that JinkoSolar Holding Co., Ltd. (NYSE: JKS) (“JinkoSolar” “JKS” or the “Company”) exists for the sole purpose of developing PRC assets with JKS’ cash that were disposed to Chairman Li at a significant discount to market. An older vintage of US-listed Chinese fraud, JKS was fattened up with 5 separate equity issuances and US$ 2+ billion in net debt only to be stripped of value by insiders. This is why JKS, despite its purported profitability, had failed to generate free cash flow or pay shareholders cash dividends.

Evidence shows that Chairman Li privatized JKS’ most valuable assets for himself, leaving JKS shareholders saddled with debts and construction cost liabilities. In 2011, JKS established Jinko Power Technology Co., Ltd. (“JinkoPower”) as a vehicle to construct solar farm power plants that sold electricity to the Chinese State Grid at up to a 33% net income margin, much more profitable than JKS’ 1% net income margin manufacturing solar modules.

In October 2016, JinkoPower was sold to Chairman Li at a US$ 455 million valuation (RMB 3.2 billion). ONE MONTH AFTER Chairman Li purchased JinkoPower at a US$ 455 million valuation from JKS, JinkoPower received an independent appraisal valuation of US$ 720 million accompanied by a PRC insider equity raise at a US$ 788 million valuation. To us, the evidence is clear that Chairman Li acquired JinkoPower at a 40+% discount to market value.

Using US$ 650+ million of JKS’ financial support, Chairman Li grew JinkoPower in 3 years as a private company to seek a US$ 3.6 billion IPO valuation (RMB 25 billion) in 2020, a valuation 692% higher than what Chairman Li paid JKS for JinkoPower!

In addition, Chinese filings reveal Chairman Li’s brother and JKS co-counder Li Xianhua secretly benefitted from controlling a signficant supplier within JKS’ supply chain, a PV glass supplier called Xinruixin, which once again resulted in value meant for shareholders ultimately making its way to Chairman Li and his brother.

Evidence showed that JKS fabricated its 2017 and 2018 financial statements by including US$ 209 million of fake sales to Australia and by omitting US$ 42 million in customs duties that JKS remains liable for in South Africa.

We are short JKS because we think its equity is ultimately worthless.